Enterprise Market Performance Evaluation Featuring 906421727, 631290051, 977776802, 8054201052, 640010196, 602791157

The evaluation of enterprise market performance for companies such as 906421727, 631290051, 977776802, 8054201052, 640010196, and 602791157 reveals critical insights into their financial health and operational efficiency. While certain enterprises exhibit strong revenue growth and effective debt management, others face challenges with liquidity ratios. This disparity raises questions about their strategic responses to market dynamics and future growth potential. The implications for competitiveness warrant further examination.

Overview of Key Enterprises

In the complex landscape of the enterprise market, key players exhibit distinctive performance metrics that illuminate their strategic positioning.

Analyzing the competitive landscape reveals significant disparities in financial health among these enterprises. While some demonstrate robust revenue growth and strong profit margins, others struggle with liquidity ratios and debt management, underscoring the necessity for strategic adjustments to enhance sustainability and market resilience.

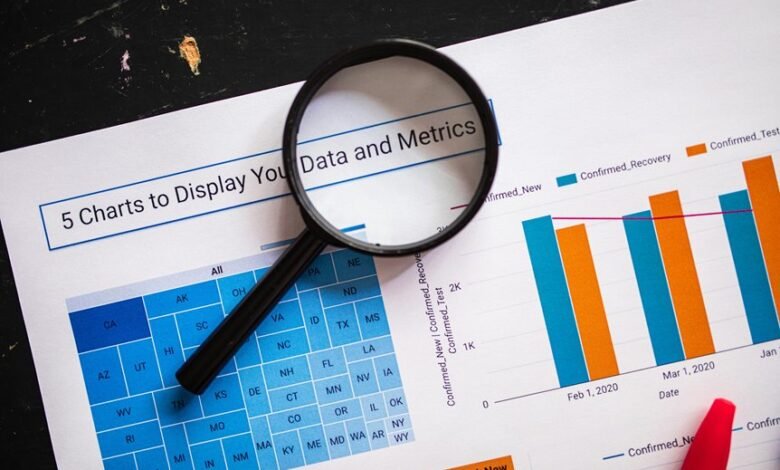

Performance Metrics Analysis

How do the performance metrics of key enterprises reflect their operational efficiency and market adaptability?

Analyzing performance indicators reveals insights into efficiency and responsiveness to market dynamics. Success benchmarks highlight areas of strength and opportunities for improvement.

Enterprises leveraging these metrics can strategically align their operations, ensuring they not only meet current demands but also anticipate future market trends effectively.

Comparative Market Positioning

While market positioning is often viewed as a static snapshot, it is, in reality, a dynamic interplay of strategic decisions and competitive actions.

Analyzing comparative market positioning reveals how enterprises adapt their positioning strategies in response to market dynamics.

This adaptability enables organizations to maintain relevancy, optimize competitive advantages, and ultimately align with consumer preferences, fostering an environment of continual growth and market responsiveness.

Future Growth Opportunities

Future growth opportunities for enterprises often hinge on the ability to leverage emerging market trends and technological advancements.

By identifying shifts in consumer behavior and investing in innovative solutions, businesses can craft effective investment strategies.

Focusing on sustainability, digital transformation, and data analytics will enable enterprises to capitalize on these trends, fostering resilience and adaptability in a dynamic marketplace.

Conclusion

In conclusion, the competitive climate for enterprises 906421727, 631290051, 977776802, 8054201052, 640010196, and 602791157 showcases a spectrum of strengths and struggles. As these entities navigate the turbulent tides of market dynamics, their ability to adapt and adopt agile strategies will shape their future fortunes. Ultimately, proactive performance practices and persistent market monitoring will propel these players toward profitable pathways, ensuring they thrive in an ever-evolving economic environment.