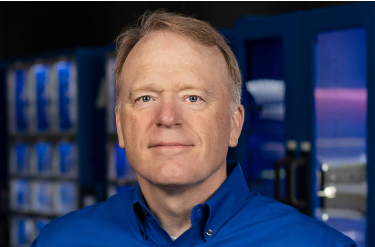

Dan Florness Net Worth: CEO’s Financial Overview

Dan Florness Net Worth: CEO’s Financial Overview, as the President and CEO of Fastenal, has not only steered the company through significant growth but also built an impressive net worth that reflects his strategic capabilities in the industrial supply sector. His comprehensive compensation structure, coupled with a diverse investment portfolio, reveals a nuanced understanding of financial management. However, the intricacies of his wealth, including the impact of economic fluctuations and comparisons to industry peers, raise questions about sustainability and future prospects. To fully grasp the implications of Florness’s financial landscape, a closer examination is warranted.

Dan Florness Net Worth: CEO’s Financial Overview Overview

Dan Florness Net Worth: CEO’s Financial Overview is a prominent figure in the business sector, known primarily for his role as the President and CEO of the manufacturing company Fastenal. His achievements include strategic growth initiatives that have significantly increased the company’s market presence.

Additionally, Dan Florness is recognized for his philanthropy, contributing to various community programs that support education and workforce development, emphasizing his commitment to social responsibility.

Read More Brooke Devard Net Worth: Podcaster’s Wealth and Success

Fastenal Company Background

Fastenal Company, founded in 1967, has experienced significant growth by capitalizing on the increasing demand for industrial supplies and fasteners.

Its extensive product and service offerings include a wide range of construction and manufacturing materials, as well as supply chain solutions tailored to various industries.

This strategic focus has positioned Fastenal as a key player in the market, driving both revenue and market presence.

Company Founding and Growth

Founded in 1967, Fastenal emerged as a small distributor of fasteners in Winona, Minnesota, and has since scaled up to become a significant player in the industrial supply sector. Key company milestones and strategic market expansion have propelled its growth, establishing Fastenal as a trusted name in the industry.

| Year | Milestone | Impact |

|---|---|---|

| 1975 | First branch opened | Enhanced regional presence |

| 1980 | IPO launched | Increased capital for growth |

| 1990 | International expansion | Global market penetration |

| 2020 | Digital transformation initiated | Improved customer accessibility |

Product and Service Offerings

The expansion of Fastenal into a comprehensive provider of industrial and construction supplies reflects its strategic response to market demands and customer needs.

Through continuous product innovation, Fastenal enhances its offerings, ensuring a robust selection of high-quality materials.

Service expansion initiatives, such as inventory management solutions, further position the company as a leader in the sector, catering to diverse client requirements efficiently.

Read More Charlie Lydecker Net Worth: Insurance Industry Leader

Leadership Journey

Although Dan Florness Net Worth: CEO’s Financial Overview initially entered the corporate world with a focus on operational efficiency, his leadership journey has evolved into a multifaceted approach that emphasizes innovation and strategic growth.

Key aspects of his leadership style include:

- Emphasis on team collaboration

- Commitment to continuous improvement

- Strategic vision for market expansion

- Focus on fostering a culture of innovation

These career milestones reflect his dynamic approach to leadership.

Salary and Compensation

Dan Florness’s salary and compensation package reflects his significant contributions to the company and the industry at large.

An analysis reveals that his earnings align with industry salary benchmarks and are influenced by prevailing compensation trends.

This positioning not only underscores his value within the organization but also serves as a competitive factor in attracting and retaining top talent in the sector.

Stock Holdings and Investments

Dan Florness Net Worth: CEO’s Financial Overview stock holdings and investment portfolio reveal insights into his financial strategy and market confidence.

An analysis of his major stock holdings indicates a diverse range of sectors, while a breakdown of his investment portfolio highlights both risk management and growth potential.

Recent stock transactions further reflect his responsiveness to market trends and economic conditions.

Major Stock Holdings

Major stock holdings play a significant role in understanding Dan Florness’s overall financial portfolio and investment strategy.

His investment decisions reflect a keen awareness of stock performance and market dynamics.

Key holdings include:

- Technology sector giants

- Healthcare innovators

- Renewable energy companies

- Consumer goods leaders

These selections illustrate a diversified approach aimed at maximizing returns while mitigating risks inherent in market fluctuations.

Investment Portfolio Breakdown

An examination of Dan Florness’s investment portfolio reveals a strategic allocation of assets that aligns with current market trends and future growth potential.

His investment strategies emphasize diversification across sectors, balancing risk and return.

Notably, the asset allocation includes equities, fixed income, and alternative investments, positioning Florness to capitalize on emerging opportunities while mitigating potential downturns in the market.

Recent Stock Transactions

Monitoring recent stock transactions provides valuable insights into Dan Florness’s investment strategy and market outlook.

His trading history reflects a keen assessment of market trends and risk levels, emphasizing portfolio diversification.

Read More Charmaine Glock Net Worth: Exploring Her Career Wealth

Notable recent trades include:

- Increased holdings in tech stocks

- Shift towards renewable energy investments

- Exit from underperforming assets

- Strategic acquisitions in emerging markets

These moves highlight his proactive financial analysis and stock performance evaluation.

Bonuses and Incentives

Bonuses and incentives play a critical role in shaping the overall compensation package for executives like Dan Florness.

These components are often tied to specific performance metrics, ensuring that incentive structures align with organizational goals.

Bonus calculations typically reflect individual and company performance, reinforcing the principles of executive compensation.

This strategic approach fosters accountability and motivation, ultimately driving long-term success for the company.

Economic Influences

The impact of economic influences on executive compensation, including bonuses and incentives, cannot be overlooked.

Key economic factors include:

- Market fluctuations affecting revenue projections

- Inflation impact influencing purchasing power

- Employment rates shaping consumer behavior

- Trade policies and industry competition affecting supply chains

These elements significantly dictate investment strategies and fiscal policies, ultimately shaping the financial landscape for executives like Dan Florness.

Comparison With Industry Peers

A comprehensive analysis of Dan Florness Net Worth: CEO’s Financial Overview in relation to his industry peers reveals significant insights into his compensation structure and overall financial standing.

Utilizing industry benchmarks and peer comparisons, Florness demonstrates effective leadership through strategic initiatives that drive revenue growth.

His financial metrics indicate a robust market positioning, making his compensation analysis particularly relevant when assessing leadership effectiveness among comparable executives.

Future Financial Projections

Looking ahead, Dan Florness’s financial trajectory appears promising, driven by a combination of market trends and strategic initiatives poised to enhance revenue generation.

Key financial trends suggest:

- Increased market share in core segments

- Expansion into emerging markets

- Enhanced operational efficiencies

- Focus on innovation and product development

These factors collectively position the company for sustained revenue growth in the coming years.

Conclusion

In summary, the financial landscape of Dan Florness Net Worth: CEO’s Financial Overview exemplifies the pinnacle of corporate achievement, characterized by a net worth that resonates like a symphony of success in the industrial supply sector. The strategic acumen displayed through his compensation structure, coupled with an impressive portfolio of stock holdings and investments, positions Florness as a titan among industry leaders. Future projections suggest an unyielding trajectory of wealth accumulation, further solidifying his status as a paragon of financial prowess and leadership excellence.